Acquisition project | The KEN

😀 Hi There, this is Gaurav Jhawar. I recently started working as a Client Engagement Manager at Innovation Scaleup Advisors after working as an APM at HiLabs (a B2B Healthcare startup).

📝 I’ve picked The KEN for my Acquisition project in Week 1.

Elevator Pitch

Abhishek, 28 year old is a young product manager working at a rapidly growing fintech startup in Mumbai. His role involves developing and launching new financial products that meet the needs of a tech-savvy, digitally connected audience. Rohan needs to stay on top of fintech trends, consumer behavior, and regulatory changes to ensure his products remain competitive. However, Rohan finds it challenging to keep up with the rapid pace of innovation in fintech. New technologies, competitors, and regulatory changes are constantly emerging, and it's difficult for him to get a comprehensive view of how these developments could impact his product roadmap.

Thenn, 32 year old is an engineering manager working at a ecommerce startup in Bangalore. His role involves managing tech team and leading development of new products from engineering side. Though he excels in his role, he dreams of starting his own company some day. He loves reading about startups and entrepreneurship ecosystem to stay updated and expand his knowledge base. However, he recognizes that still his knowledge is primarily technical, and he lacks experience in business strategy, marketing, and the broader dynamics of running a startup.

Ratan, 26 year old is an Entrepreneur at a media tech startup working remotely. His role involves leading his team to pull off successful growth campaigns. He often has to pull 15 hour work days at his station and thus struggles to anticipate future trends in this age of constant shift in market dynamics. Without targeted insights and actionable strategies, it’s challenging to innovate and stay ahead in a rapidly evolving industry. This lack of a strategic edge is hindering his ability to make informed decisions and drive self growth.

🚀 Introducing The KEN, delivering sharp, insightful analysis on technology, business, and policy across India and Southeast Asia.

❎ No clickbait, no fluff—just deeply researched, narrative-driven journalism that keeps you ahead of the curve.

💡 For decision-makers and innovators who value quality over quantity.

💰 Subscribe to The KEN, the only business subscription you need. Delivered every morning straight into your inbox!

About The KEN

Criteria | Description |

|---|---|

What is the Ken? | Subscriber-only business news publication |

Founded | 2016 |

Company Stage | Series B |

Team Size | 10-50 employees |

Devices | Available on Mobile (across Android and iPhone) & Web |

Monetization | Subscription first revenue model |

Region(s) | India and Southeast Asia, although subscribers are from around the globe. |

Offerings | Individual Subscriptions, Group Subscriptions (Campus and Corporate) |

Total Subscribers | 5,00,000+ |

Delivery Mechanisms | Stories, Visual Stories, Newsletters, Podcasts |

Core Value Proposition | 1. Deep, Meticulously Researched Journalism: Provides in-depth, well-researched stories that go beyond surface-level news |

Why pick The KEN?

My story of discovering their unique style of writing

- It was in 2022 when I first discovered KEN through my college placement preparation materials where a college senior had put down The KEN into reference materials. Also, when I spoke on a call with a few more seniors- majority mentioned it being a useful subscription to have since I was primarily targeting business roles.

- With a strong word of mouth, I finally decided to give this a shot and I purchased the subscription while being a college student. I was already having a newspaper subscription so switching to KEN’s content was not too difficult for me as I had a habit of reading content which had longevity.

- Impact? It very quickly became a part of my morning routine, where I spared 20 mins everyday to go through the article in detail. I waited very week to read The NUTGRAF edition by Praveen Gopal Krishnan.

The KEN’s performance till date

- Total Subscribers: 5,00,000+

- Average Rating of 4.8/5 (iOS) and 4.7/5 (Android)

- Their Journey

- Raised Angel rounds in 2017-18 with notable participants like Vijay Shekhar Sharma

- Raised Series A $1.5M in 2018

- Raised Series B $2M in 2023

A room full of opportunity

- Niche content with lower barriers to entry- While newspapers were rewarded for more information, digital is all about specialization, given that the time of the user is scarce. However, there is immense scope of exploration here as only 2% of the total user time spent on digital news was via Digital natives.

- The Ad funded model of news has been disrupted- Globally the Ad funded model has been on decline as seen in the chart below. The revenue model of publishers has been disrupted globally and India is currently observing a similar trend at a smaller magnitude.

3. Trust in news has fallen in line with global trends:

Trust in news has dropped over time, with social media being the least trustworthy channel. Not surprisingly, more Indian users are accessing news on Social Media (24%). Consumers seeking news are often flooded with advertisements and promotional content that looks like news. Enter The KEN, which cuts through all the BS, has no banners and Ad model, just a subscription based offering behind a paywall.

- Emergence of new models in Digital can either aid as well as harm KEN’s business model: News aggregator models gives access for consumers to diverse news on multiple topics. If the ability to invest in news increases, unbundling and micropayments may come in the limelight but can hurt quality if it cannibalizes subscribers.

Let’s talk the ICP

Sample Size- 12 interviews over Google Meet & Slack Huddle, 3 feedback reports online, and lots of side research from Reddit, Quora and Grapevine.

Lets look at where the customers come from? (Demographics)

Please scroll right to see all the ICPs

| Rishav | Thenn | Varghese | Venkat | Chethan | Zulfiqar | Abhishek | Rutvik |

|---|---|---|---|---|---|---|---|---|

Age | 27 | 34 | 26 | 47 | 33 | 30 | 25 | 24 |

Marital Status | Unmarried | Married | Unmarried | Married, Children | Married, Children | Unmarried | Unmarried | Unmarried |

City | Mumbai | Bengaluru | Cochin | Chennai | Bangalore | Chicago | Pune | Bengaluru |

Income Level | 2L | 4L | 1.5L | 5L | 1L | 0 | 1.25L | 1.5L |

Highest Education | BBA | MS | B. Tech | MBA | B. Tech | MBA | B. Tech | B. Tech |

Occupation | Chief of Staff | Engineering Manager | Product Manager | Entrepreneur, Angel Investor | Career Break | MBA Student | Product Manager | Data Scientist |

Company | The Belgian Waffle Company | Shopmatic | Xandu | Little Feet Services | At Home | Northwestern University | My Operator | Delhivery |

Time vs Money | Time over Money | Time over Money | Time over Money | Time over Money | Time and Money | Time and Money | Time and Money | Time and Money |

Where do they spend time at? (Behaviors)

Please scroll through right for all ICPs

| Rishav | Thenn | Varghese | Venkat | Chethan | Zulfiqar | Abhishek | Rutvik |

|---|---|---|---|---|---|---|---|---|

Brands | Apple, Starbucks, ZARA, Louis Phillippe, Bira91 | Skechers, USPA, CultFit, Arrow, Titan | Westside, tata cliq, apple, urban ladder | Tissot, Apple, Taj Hotels, Gabit, Gant, Nautica | FirstCry, boAt, Myntra, OnePlus, Zudio | Apple, Tim Hortins, Microsoft, Zara, Nike | Nothing, Shoppers Stop, Nike, Blue Tokai, Fitbit | OnePlus, Cult Fit, Westside, Zomato Live |

Social Media Apps (order in usage time) | LinkedIn, Instagram, Whatsapp | LinkedIn, Twitter, Whatsapp | Instagram, Youtube, Whatsapp | Twitter, Facebook, LinkedIn | Youtube, LinkedIn | LinkedIn, Twitter, Youtube | LinkedIn, Instagram, Whatsapp | LinkedIn, Instagram, Whatsapp |

Entertainment Apps | Spotify, Netflix, Prime | Spotify, Netflix | Netflix, Spotify | Gaana, Prime Video | Hotstar, JIO Cinema | Spotify | Netflix, Spotify | Spotify, Prime |

Finance | GPay, Stable Money, Groww, MoneyControl | Kite, ET Prime, CRED | Groww, Slice | Gpay, Economic Times, Kite, HDFC Bank | PhonePe, Upstox, ICICI Bank | Paypal, Groww | Gpay, Groww | Cred, Groww |

Productivity | Calendly, Slack, Office 365 | Office 365, Slack | Google Meets, Slack | Office 365, Calendar | Slack | LMS | Office 365, Slack, Fireflies | Slack, Google Spreadsheets |

Health & Fitness | Does not get much time | Strava, Cult, personal trainer | Healthify | Gabit- Smart Ring, Meditation | StepSetGo | Nike training club, meditation | Nike Training Club | Home workouts |

Weekends | Community Meetups, drinks with friends, comedy shows, underground vehicle showcase | community meetups, dinner with family, live music shows with friends, long distance cycling | plays music, goes to dance workshops, focused reading, meetup with friends | Gives talks on gen ai at various events, leads community events, travels to client locations at new places. | grocery shopping for home, dinner with family, movie shows with friends | Spends time running and cycling around the town, watches long podcasts, travels to sisters place once in 2 weeks. | Loves watching cricket matches, books a turf and plays sports with friends, dinner with family. | New cuisine food outings with friends, talk-shows on business and AI, speaker- shows on MBA |

Values | Values innovation, premium quality, and brand reputation. He appreciates products and services that offer a blend of luxury and functionality. | Prioritizes fitness, personal growth, and professional development. He values brands that align with his active lifestyle and commitment to self-improvement. | Values creativity, cultural experiences, and continuous learning. He seeks out brands that provide unique experiences and contribute to his artistic and intellectual pursuits. | Highly values knowledge sharing, community leadership, and technological advancements. He aligns with brands that emphasize thought leadership and professional excellence. | Highly values knowledge sharing, community leadership, and technological advancements. He aligns with brands that emphasize thought leadership and professional excellence. | Values a balanced lifestyle, health, and well-being. He is drawn to brands that promote a healthy lifestyle and offer quality, reliable products. | Values a balanced lifestyle, health, and well-being. He is drawn to brands that promote a healthy lifestyle and offer quality, reliable products. | Values professional success, innovation, and cultural exploration. He seeks brands that are at the forefront of technology and business, while also offering enriching social and cultural experiences. |

How are they consuming Content?

Please scroll right to see all the ICPs

| Rishav | Thenn | Varghese | Venkat | Chethan | Zulfiqar | Abhishek | Ruthvik |

|---|---|---|---|---|---|---|---|---|

Free Online Apps | Morning Brew, CFO brew, Finshots | Finshots, Inshorts | Spotify podcasts, youtube podcasts, Finshots | The Verge- decoder | Finshots, Youtube podcasts, LinkedIn | Finshots, LinkedIn news | Finshots, LinkedIn news, inshorts | Finshots, free substack newsletters |

Paid Subscriptions | Economic Times, The KEN | Forbes, Wired, the morning context, The KEN | The KEN | Register UK, NY Times, This week in tech, The KEN | The KEN | The Wall Street Journal, The Economist, 404 media, Rest of world- The wire | ET Prime, The KEN | The KEN |

Physical (Books/Newspapers) | Self help books and biographies | A mini library at home, Economic Times | Does not read on regular basis | The Times of India, Indian Express | NA | The Economist, organizational thinking books | Business books, productivity books | Economic Times, Psychology books |

Interests | Personal Finance, current affairs, business and startup news | Startup teardowns and breakdowns, indian entrepreneurs, current business news | Stock Market, Entrepreneurship, Economic Policy | Indian Politics, Generative AI, Angel Investing, Indian Startups, Tech for Good, Climate Change | business news, startup breakdowns, entrepreneur biographies, growth and product strategies of MnCs | business and political news, has different subscriptions for both of them. Likes to follow pharmaceutical and healthcare | startup deep dive, indias budding entreprenurs, product growth strategy newsletters | startup news, insider news regarding esops, layoffs which does not get covered elsewhere, new product launches |

Delivery Mechanism | Prefers textual over audio/video | Prefers textual with infographics over audio/video | Prefers Video/Audio content over textual | Prefers textual over audio/video | Prefers video/audio over textual | Prefers long form articles but recently started exercises so investing time in podcasts as well. | Prefers textual content over video/audio | Prefers textual content over video/audio |

Total Time Spent | 45 mins to 1 hour everyday | 2-3 hours everyday | 30 mins to 1hour everyday | 1-2 hours | 2-3 hours | 1-2 hours | 40-45 mins | 1-2 hours |

When do they consume? | Morning and in the evening before dinner | Mostly in the evening | Mostly in the evening | Throughout the day | Throughout the day | Throughout the day | Morning | Throughout the day |

Goals |

|

|

|

|

|

|

|

|

Pain Points |

|

|

|

|

|

|

|

|

ICP Prioritization Framework

Please scroll right to see all the ICPs

ICPs prioritized for Acquisition: Sophisticated Rishav, Knowledge Seeker Thenn, Tech Leader Venkat, Tech Savvy Ruthvik

Criteria | Adoption Rate | Appetite to Pay | Frequency of Use case | Distribution Potential | TAM |

|---|---|---|---|---|---|

Sophisticated Rishav | High | High | Moderate | Moderate | Moderate |

Knowledge Seeker Thenn | High | High | High | Moderate | Moderate |

Creative Explorer Varghese | Moderate | Moderate | Low | Moderate | Low |

Tech Leader Venkat | Moderate | High | High | Moderate | Moderate |

Family-Centric Chethan | Low | Moderate | Low | Low | High |

Disciplined Zulfiqar | High | Moderate | Moderate | Moderate | High |

Active Achiever Abhishek | Moderate | Moderate | Moderate | Moderate | Moderate |

Tech Savvy- Ruthvik | High | Moderate | High | High | High |

Note: The sample is fairly biased towards people in Growth, PM and non-tech domains since majority of them are from GrowthX cohort, and demographic wise it is focused mainly on Metro, Tier-1

Market Size

Assumptions: We are calculating the Market Size for the Indian population since a majority of its customer base is currently for India, however it has to be noted that they have subscribers from round the globe as they also cover the South East Asia region in their publication

💡 We will calculate the Market Size using the Top Down approach, starting with the population of India.

Metric | Criteria | Breakdown | Revenue Potential | Explanation |

|---|---|---|---|---|

TAM | Total Population of India | 140 Cr | ||

Urban Population (40%) | 56 Cr | |||

Internet Users (90%) | 45 Cr | Since KEN is a digital platform, only users with Internet can be reached | ||

Reach of digital news (80%) | 38 Cr | Reach of digital news will be 80% of total people with internet connection | ||

English Speaking urban Population (40%) | 16 Cr | The KEN is not on vernacular mode still | ||

Digitally literate people (90%) | 15 Cr | The KEN can only be understood by people with a decent level of education | ||

High Income and Middle Income professionals (40%) | 6 Cr | Since KEN is a premium subscription only high or middle income level people will be able to afford it. | ||

Business professionals, non-tech roles (20%) | 1.2 Cr | Since KEN is primarily for people towards business or tech side, putting a filter for that as well | ||

SAM | = 1.2 Cr * 5,000 (annual subscription price) = Rs. 6000 Cr | |||

Willingness to pay (40%) | 0.5 Cr | |||

Competitive adjustment (50%) | 0.25 Cr | |||

SOM | =0.25*5,000 = 1250 Cr | |||

Ability to Win (30%) | 0.075 Cr | |||

Serviceable Obtainable Market (realistic) | = 375 Cr | Accounts to total paying subscribers = 7,50,000 |

The above calculation without adjustment to growth rates reflect that The KEN realistically has the potential to reach a total of 7,50,000 paying subscribers (approx. 15X) compared to their current paying subscriber base of 50,000.

The calculation systematically has taken into account that the KEN in the near future will not dive into vernacular content and will continue to be a premium English subscription.

Also, KEN’S total subscribers stand at 5,00,000 (free + paid) while according to our estimation it has the potential to reach a total of 1,20,00,000 subscribers in the near future.

Competitor Analysis

Criteria | The KEN | The Morning Context | ET Prime |

|---|---|---|---|

Founded | 2016 | 2018 | 2016 |

No. of paid subscribers | 40,000 | 10,000 | 20,000 |

What is the core problem being solved by them? | Lack of in-depth, analytical, and well-researched content in business, tech, and regulations | Need for investigative, narrative-driven journalism in technology, business, and culture. | Requirement for premium, exclusive business content with deep insights and analysis. |

Who are the users? | Angel investors, CXOs, Founders and Non-tech industry | Senior management, mid-level management, tech and non-tech industry | Business professionals, secondary market investors, retail investors |

Products/Features/Services | Long-form, subscription-based articles, podcasts, newsletters | long form and short form news briefs | Premium articles, reports, and insights focusing on business, finance, and markets. |

GTM strategy | Focus on content quality and unique insights, leveraging word-of-mouth and niche marketing. | Emphasizes narrative storytelling and deep investigations, often using social media and partnerships. | Leverages the credibility of The Economic Times, with a focus on digital marketing and content distribution. |

Pricing Model | Individual subscriptions PER YEAR starting at (Rs. 3000, most bought (Rs. 5000), Corporate subscriptions | Individual subscriptions starting at Rs. 200 per month | Individual subscriptions starting at Rs. 2000 per year |

User Experience | Minimalist and clean design. | Engaging and immersive design. | Professional and user-friendly design. |

Funding | Angel investors, Venture capitalists | Venture capitalists | Funded by Economic times resources |

Lessons to learn | Importance of niche content and high-quality journalism in attracting dedicated readers. | Value of strong storytelling and investigative journalism to build a loyal subscriber base. | Leveraging established credibility and integrating with existing networks to enhance market position. |

Acquisition Channels

Channel Selection Framework

Channel Name | Cost | Flexibility | Effort | Speed | Scale |

|---|---|---|---|---|---|

SEO | Medium | Medium | High | Medium | High |

Paid Ads | High | High | Low | Fast | High |

Content Loops | Low to Medium | High | High | Slow to Medium | Medium to High |

Referral | Low | High | Medium | Medium | Medium to High |

Partnerships | Medium | Low | High | Slow | High |

Integrations | Medium | Medium | Medium to high | Slow to Medium | Medium to High |

Influencer Marketing | Medium to High | Medium | High | Medium | Medium to High |

Social Media Marketing | Medium | High | Medium | Mediun | High |

Email Marketing | Low to Medium | High | Medium | Medium to High | Medium to High |

Paid Ads

Let's first calculate the CAC to LTV ratio for The KEN and validate if the ads will be economically viable

Lifetime Value (LTV) = AOV X Margin X Frequency X Retention

AOV = INR 5,000 (This is the most sold plan inside the ken)

Margin = 0.7 (industry average)

Frequency = 1 per year (ken has to be purchased once a year)

Retention = 2 years (an average ken consumer usually sticks around for 2 years)

LTV = 5000 * 0.7 * 1 * 2 = 7,000

Customer Acquisition Cost (CAC) = 1,250 (Based on external references)

CAC/LTV = 1250/7000 = 1:5.6

A 1:5.6 ratio indicates we can significantly more revenue from each customer than what it costs to acquire them, allowing for higher margins and potential reinvestment into further growth or other strategic initiatives.

Such a ratio suggests that the business has room to scale. If we can maintain this ratio as we increase our marketing spend, it could lead to rapid growth.

Let's now look at the Ad Channel selection framework and rank our best channels

| CAC | Flexibility | Effort | Time | ROAS | LTV |

|---|---|---|---|---|---|---|

Facebook Ads | Medium | High | Medium | Medium | Low | Medium |

Instagram Ads | Medium | High | Medium | Short | High | Medium |

Google Ads | High | Medium | Medium | Short | Medium | High |

LinkedIn Ads | High | Medium | Medium to High | Short | High | High |

X Ads | Medium | High | Medium | Short | Medium | Medium |

Display Ads (GDN) | Low | High | Low | Short | Low | Low |

Native Ads | Medium | Medium | Medium | Medium | Medium | Medium |

Lets now select the Top 3 channels

So based on the analysis above, we have prioritized the below 3 channels for Paid Ads:-

- Instagram Ads- Instagram Ads are effective for engaging with visually oriented audiences and offer high returns with relatively quick results. They are particularly beneficial for brand awareness and engagement.

- Google Search Ads- Google Search Ads capture users with high intent, which can lead to strong conversion rates and high customer lifetime value. Although CAC is higher, the quality of leads and targeted reach make it valuable.

- LinkedIn Ads- LinkedIn Ads are particularly effective for targeting professional audiences. Despite the higher CAC and effort, the potential for high LTV and ROI justifies its place as a top channel.

Lets now select the Ad channel and Audience

Instagram Ads:

Ad Set 1: Visual Storytelling for Brand Awareness

Objective: Brand Awareness and Engagement

Lets look at the target audience

ICP will be Tech Savvy Ruthvik from our prioritised user personas

Criteria | Factors |

|---|---|

Demographics | Age 22-32 |

Interests | Business news, tech trends, entrepreneurship, startups, personal finance |

Behaviours |

|

Location | Metro, Tier 1 (india, Indonesia, US) |

Ad Creative:

Which type of Ad we will be implementing

For The KEN, Carousel ads to showcase multiple stories, articles, or subscription benefits within a single ad unit. Each card can highlight a different piece of content or a unique selling proposition, such as in-depth analysis, exclusive interviews, or thought leadership.

Building the Ad Concept

Purpose: Engage users with stories or case studies that highlight the impact of The Ken’s journalism.

Ad Structure:

- Card 1: Introduction to a significant story covered by The Ken (e.g., a business trend or startup success).

- Card 2: Key insights or data from the article.

- Card 3: Quote or testimonial from someone featured in the story.

- Card 4: Link to related articles, showing the breadth of coverage.

Step-by steps screenshots are attached below

LinkedIn Ads

Ad Set 1: Executive & Decision-Maker Targeting

Objective: Lead Generation & Conversion

Lets look at the target audience

ICP will be Tech Leader Venkat from our prioritised user personas

Criteria | Factors |

|---|---|

Job Titles | C-Level Executives, Directors, VPs in finance, technology, or consulting industries |

Industries | Finance, Technology, Consulting, Startups |

Company Size | Mid to large-sized companies |

Location | Metro, Tier 1 (india, Indonesia, US), major business hubs, tech parks |

Ad Creative:

Which type of Ad we will be implementing

For The KEN, Sponsored InMails on LinkedIn are a highly effective way to reach a professional audience directly and personally. Driving subscriptions among high-level professionals by showcasing the value of The Ken’s in-depth business journalism.

Screen-1

- Personalised subject line with the industry

- Value Proposition throughout the mail

- Social Proof by showing relevant work

- Clear CTA at the end to ask the user for free trial

Organic Channel

Type of search | Keyword | Volume | Position | Estimated Monthly visits | SEO difficulty | Time to fix the reach | No. of potential signups |

|---|---|---|---|---|---|---|---|

Use Case | best indian business newspaper | 1000 | 49 | 0 | 42 | Medium | Medium |

startups newsletter | 5400 | 67 | 0 | 18 | Medium | High | |

defence startups in india | 390 | 78 | 0 | 6 | Low | High | |

drone startups in india | 480 | 93 | 0 | 26 | Low | High | |

success story of startups | 320 | 81 | 0 | 2 | Low | Medium | |

Product | Trade tricks | 27100 | 2 | 1930 | 47 | Low | Low |

Ka-ching | 1000 | 4 | 23 | 24 | Low | Low | |

Rohin Dharmakumar | 320 | 2 | 39 | 18 | Low | Low | |

Direct search | The KEN subcription | 590 | 1 | 220 | 19 | Low | High |

Content | Stoa | 6600 | 2 | 198 | 33 | Low | Medium |

Licious layoffs | 480 | 2 | 25 | 26 | Medium | Medium | |

Swiggy IPO | 8100 | 4 | 215 | 24 | High | Medium | |

Bain | 720 | 2 | 83 | 18 | High | Medium | |

Jiomart b2b | 590 | 3 | 27 | 24 | Medium | Medium |

The KEN is currently at the stage of early scaling where they are yet to figure out the SEO game.

Opportunities to improve the SEO and organic search:

- Focus on niche sector specific content and well researched words: The KEN usually covers a story which has a sector at the core of it and a few disruptive startups a part of that story. With domain specific content already on the website which is well researched and tagged, it is beneficial for the KEN to focus on improving the search for them. Like: Defense startups, drone startups, quick commerce etc

- Company specific information: As seen on the table above the stories are tagged with famous company names and do a well researched analysis on it. With the promise of quality and in-depth content behind the paywall, KEN can increase the number of subscribers.

- Direct Search burden: Currently the top rated organic searches actually are about the product (The KEN) or the sub products (Trade Tricks, Ka-Ching) potraying that a majority of these are actually the word of mouth searches when a user has been recommended the KEN by their colleagues or their friends, opening the room for immense upside potential.

Content Loops

Platform | Engagement Rate | Impact of Engagement | Content Type Suitability | Reach |

|---|---|---|---|---|

Medium | Low | Infographics | Medium | |

Medium | Medium | Infographics, text | High | |

X | Medium | Medium | Short text based | High |

Gmail | High | High | Long form | Low |

Comments | High | High | Long form, flexible | Low |

Medium | Low | Links | Low |

Taking an example of one of the content loop, where there is scope of improvement:

Painpoints of our target persona in the current content loop:

- Taking an example of the user flow at X, which is a short form messaging platform. The KEN currently has the below content loop on XProblems with the current flow:

- X is a short form content sharing platform, sharing the whole link lacks idea and may seem as SPAM

- User generally uses X to show their thoughts and stance rather than telling a whole story or defining a case study.

- The messaging when the user goes to X is very vague which is kind of machine oriented and not user friendly. This can be solved with the new flow mentioned below

Converting the user painpoints by principles of personalization as well as ensuring the branding required to be in the limelight of new users.

Referral

💡 During UX research it became quite evident that the users were consuming content one way, with very less thought of sharing and spreading the word on social media. The case with The KEN is unique as there is plenty of word of mouth going on as we saw on the organic search also as well as was verified with the users. So finding out, where the referral flow has pitfalls and where can it be improved is important.

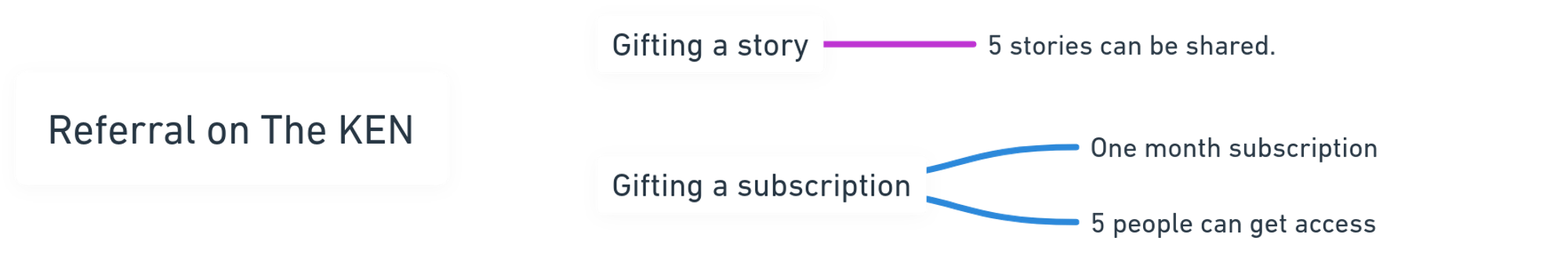

User flow for Gifting a subscription:

Based on the UXR these are the problems with the current flow:

- No incentive for the referrer

- No call to action for the referee , regarding till when they sign up

- No rewards if the referee subscribes after 1 month to premium subscription

Changes in the flow:

- Adding a benefit for the referrer

- Screen 4, adding a CTA (Expires in 24 hours)

- Screen 5, adding a scheduling which informs the referrer how many days the gifted subscription is being used, which creates a compelling nudge to see if the referree will subscribe to the KEN.

Product Integrations:

Can The KEN have product integrations with any apps that our target ICPs have:

Lets look at the apps, the ICP uses and rank them on a variety of factors

What product do they interact with? | Slack | Office 365 | Strava | Inshorts | Uber | CRED | |

|---|---|---|---|---|---|---|---|

How frequent do they interact with them? | Multiple times in a day | Multiple times a day | Daily | Daily | Daily | Daily | Daily |

How important are those interactions? | High, central to team communication | High | Moderate | High, professional networking | High | Moderate | Moderate |

Can your product add value to those interactions? | Yes, daily updates can enhance knowledge | Yes, daily briefings | Low | Yes, sponsored content and insights | Yes | No | Yes |

Time to go live | Medium | High | Moderate | Low | Moderate | Low | Moderate |

Tech Effort | Medium, involves development and integration with Slack API | High, involves integrating with Office add-ins or APIs. | Moderate | Moderate | Moderate | Low | Moderate |

New user we can get? | High | High | Low | High | Moderate | Low | Moderate, financial-savvy users may find value. |

Summary of Product Integrations Prioritization

High Potential Integrations: Slack, Office 365, LinkedIn, and Inshorts stand out as promising integration options due to their relevance, frequent user interaction, and potential to add significant value with The Ken’s content.

Low Potential Integrations: Strava and Uber have limited potential for integration with The Ken’s content due to low relevance and potential disruption to user experience.

Moderate Potential Integrations: CRED has moderate potential, particularly if tailored financial content is provided, but it requires careful consideration of how The Ken’s content would enhance the app’s existing features.

Lets design a flow for Slack

SLACK INTEGRATION

Who are we designing for?

Audience Segment | Tech Savvy Ruthvik | Sophisticated Rishav | Tech leader Venkat |

|---|---|---|---|

Description | Analyzes market trends and business performance, often working with data and insights. | Manages a team and uses Slack for day-to-day communication and collaboration. | Responsible for high-level strategic decisions and company direction. |

Key Characteristics | Data-driven, requires in-depth reports and analyses. | Regularly engaged in team coordination and communication. | Focused on strategic planning, needs high-level insights. |

PainPoints | Needs detailed and relevant reports for analysis. | Needs to share relevant industry updates with the team. | Needs access to high-quality, curated insights for decision-making. |

Opportunities | Provide in-depth and data validated articles. | Providing team-specific updates and easy sharing options. | Premium content and executive summaries delivered directly. |

Value from integrations | Detailed articles and data-driven insights that support analysis and reporting tasks. | Daily briefings and relevant content that can be shared with the team, enhancing team knowledge. | Curated, high-quality insights to guide strategic planning and decision-making. |

The KEN inside SLACK

Outlining the steps a user will take from discovering the integration to actively using it. Here’s all the steps a user might take:

- Find The Ken’s Slack Integration: Users discover The Ken’s Slack integration through the Slack App Directory or marketplace.

- Installation: Users click the “Add to Slack” button on the integration page. Users are redirected to Slack’s authorization screen where they grant permission for The Ken’s integration to access their Slack workspace.

- Setup/Configuration: Users choose which Slack channels or direct messages will receive updates from The Ken and set preferences (e.g., frequency of updates, types of content).

- Welcome Message: Users receive a welcome message from The Ken’s Slack bot, explaining the features and how to interact with the bot. An interactive tutorial guides users through the setup process and demonstrates how to use the bot’s features.

- Daily Use: Users receive daily or weekly briefings, summaries, or alerts about new content from The Ken directly in Slack. Users can use custom Slack commands (e.g.,

/theken latest) to request specific articles or updates. - Engagement: Users read and engage with the content provided by The Ken. Users share valuable insights or articles with their team via Slack channels or direct messages.

- Support and Maintenance: Users can use help commands (e.g.,

/theken help) to access FAQs or support resources.

Now lets look at the Wireframes

Demo User Flow for Sohisticated Rishav, who is looking to setup the KEN in his slack

Step-1:

Step-2:

Step 3:

Step-4:

Step 5:

Step 6:

Step 7:

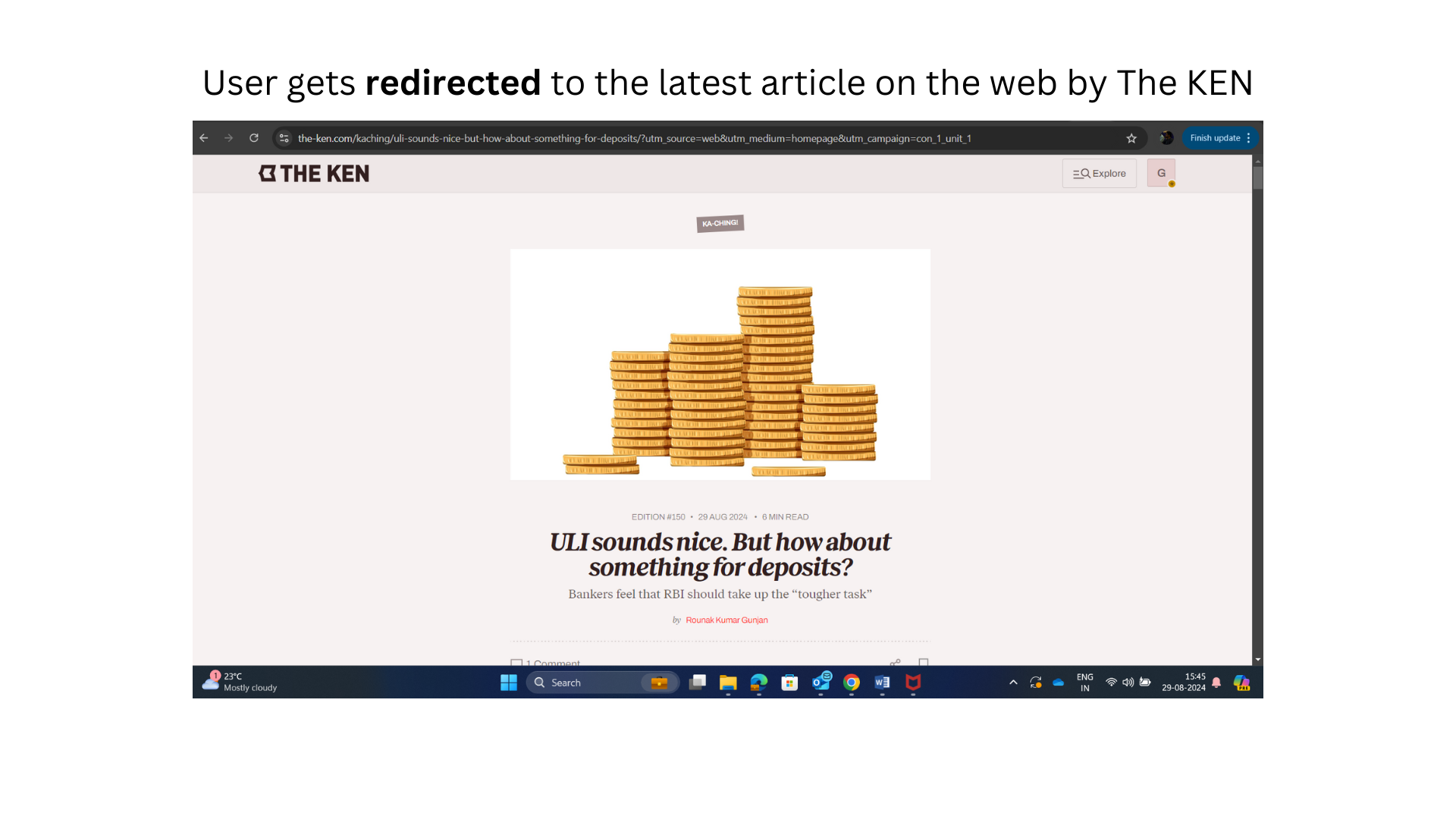

User Flow 2 for Tech Leader Venkat who integrates KEN, and receives subscriber highlights for the day:

User Clicks on Read Full article and gets redirected to The KEN website

Thank YOU!!!!

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.